Data-driven investment decisions.

Through robust data tracking and quality assurance, VisionTrack promotes accurate, credible, and trusted insights for sophisticated investors, allocators, and fund managers.

Through robust data tracking and quality assurance, VisionTrack promotes accurate, credible, and trusted insights for sophisticated investors, allocators, and fund managers.

A monthly report providing a comprehensive analysis of cryptocurrency hedge fund performance, market trends, and macroeconomic factors affecting the crypto hedge fund space.

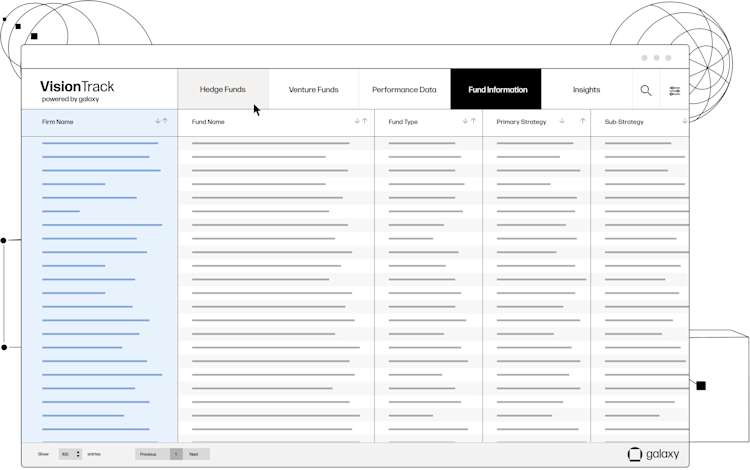

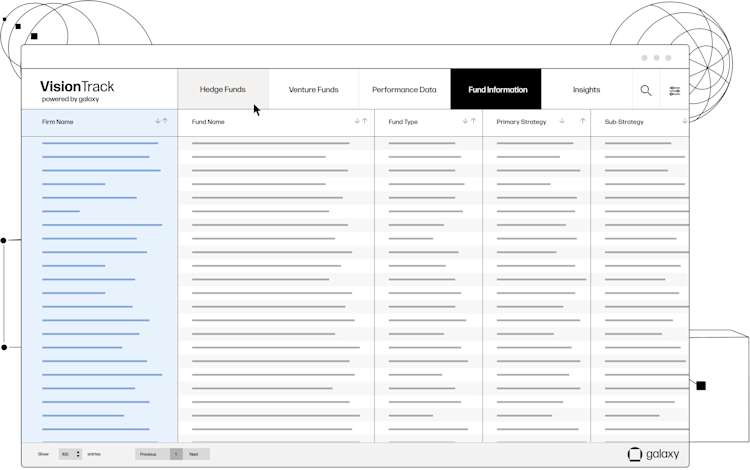

The VisionTrack database categorizes and segments all crypto funds using our industry leading strategy classifications making it easy to analyze manager performance.

Access to premium research for contributors and subscribers on Hedge Funds and Venture Funds quarterly on related market trends, industry benchmarks, and landscape observations.

VisionTrack includes global coverage of over 2,000 crypto-dedicated Hedge Funds and Venture Funds.

In-depth fund-specific insights, such as historical fees, lock-up periods, and more for fund managers to best position in the market.

Supported by a robust, exclusive list of actively managed funds, contributors have access to easy to use historical performance data as early as 2014.

Authentic and accurate contributed data with daily updates to promote stronger visibility for the greater development of the crypto and digital asset class.

The VisionTrack database increases fund managers visibility into competitors and investors within crypto.

Receive easy access to the large and growing audience of institutional and accredited investors.

Showcase solid performance and stand out amongst peers.

Streamline the tracking process to accelerate potential investment considerations.

Increase confidence with investors through transparent and quality data.

Contribute to market-leading active management benchmarks.

Participate alongside some of the largest, institutional funds in the space.